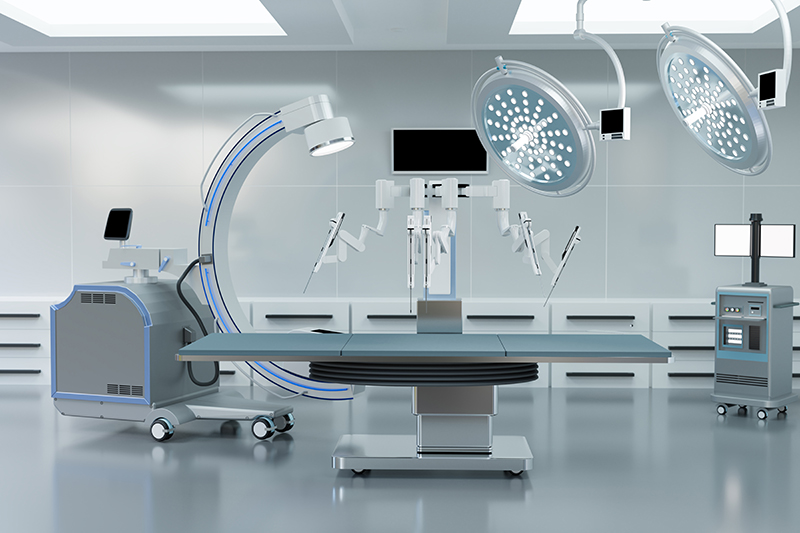

Medical Equipment

An Operating Equipment Lease is a beneficial option for business owners who finance equipment that quickly becomes obsolete, such as medical equipment. This lease is designed for customers who expect the value of their equipment to decrease quickly and plan to upgrade it at the end of the term for a new piece of equipment. Certain professions, such as those in medical and computer technology, often require working with the latest, most advanced systems, and an operating lease can help manage that requirement by allowing businesses to exchange the system for a new one every 2-3 years.

At the end of an Operating Lease, which is also known as an FMV (fair market value) equipment lease, there are three options available. These include extending the term to pay it off for full ownership, returning the equipment and potentially replacing it with newer equipment, or buying it at fair market value, which is usually 10%-20% of the original sales price. This equipment lease allows for the lowest monthly payments, and you can typically write off 100% of your payments as an operating expense since the structure is considered a rental. As a rental, it will not appear on your financial statements as debt, improving your operating ratios. It is recommended that you consult your accountant to determine how taxation applies to your specific business. In recent years, many owners have opted for an operating lease because the payments are the lowest, and they plan to keep the machine for a longer term and pay off the FMV payment with future revenues.

Medical Equipment We Finance:

-

- CT/CAT Scanners

- Magnetic Resonance Imaging (MRI)

- Ultra Sound Machines

- Surgical Robots

- Mammogram Machines

Operating Lease Fair Market Buyout:

-

- Three options at end of lease

- Can write off up to 100% of payments as operating expense

- Does not appear on your financial statements as debt

- Operating lease provides lowest payments with option to pay off the FMV payment with future revenue

The term length and rate are determined by the type of equipment being financed including the business and personal credit. Closely held businesses will normally require a personal guarantee. Larger companies with numerous owners or non-profit groups will not require a personal guarantor if the credit and cash flow are adequate. Capital Financing can be approved very quickly as we can review a request by providing current financial statements.